Distinctive lenders have distinct expectations for what an acceptable DTI is; a credit card issuer might view a person with a forty five% ratio as acceptable and concern them a bank card, but someone who offers particular loans may see it as too high instead of prolong an offer.

You can also begin to see the loan amortization routine, or how your credit card debt is lowered over time with regular principal and curiosity payments. If you wish to repay a mortgage prior to the loan time period is more than, You should utilize the calculator to figure out how considerably more you have to shell out on a monthly basis to realize your goal.

A person which has a significant ratio is observed by lenders as someone that may not be able to repay the things they owe.

Although DTI ratios are greatly utilized as complex resources by lenders, they can also be utilised To guage individual economical wellbeing.

Household fairness could be the part of your own home you’ve compensated off. You can use it to borrow for other economical plans.

A private loan is an unsecured, lump-sum loan that's repaid at a fixed level around a certain timeframe. It can be a flexible loan as it may be used to consolidate credit card debt, pay off larger-fascination bank cards, make home advancements, purchase a wedding or even a trip, buy a boat, RV or make Another significant acquire.

Here are a few facts about the commonest kinds of loans as well as loan calculators which can help you in the procedure.

When you've got outstanding credit and desire to manage anyone facial area-to-deal with you should consider using your lender or credit history union. While on line lenders can offer fantastic customer support and rapid processes, some folks dislike the lack of human link They might knowledge with on the web lenders. In the subsequent part We're going to Review your options in more element.

Multiply that amount by the remaining loan stability to Discover how Substantially you can pay in desire that month.

We now have calculated this determined by publicly offered details from the lender and your quest terms. The loan expenses may perhaps click here range dependant upon the loan volume, loan period, your credit score record, and various variables.

When you're needing a $1400 loan and possess poor credit history, there are various possibilities you'll be able to think about. Even though it could be more difficult to obtain a loan that has a reduced credit rating rating, it's not unattainable. Here are some ideas:Examine on-line lenders: Male...

The eligibility requirements for a $3200 loan with undesirable credit history may vary according to the lender. Having said that, some frequent requirements may possibly include things like:

Bankrate’s household fairness calculator aids you figure out exactly how much you may be ready to borrow depending on your credit rating rating as well as your LTV, or loan-to-price ratio, which is the difference between what your property is truly worth and the amount of you owe on it.

Once you enter your loan facts, the personal loan calculator shows a few figures: full curiosity, full compensated, and month to month payment. You can use them To guage and compare particular loans.

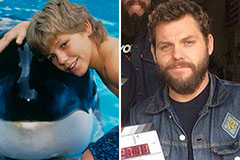

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!